WHAT IS A MORTGAGE CALCULATOR, AND HOW TO USE IT?

Today in this article, I will tell you about mortgage calculators and how you use them. Whether you are ready to buy your first home or you are ready to refinance your current house, a mortgage calculator can help you understand your yearly payment. It’s important to understand how your interest rate, down payment, property position, term, and other factors can affect your mortgage payment. Find out how to use a home loan calculator and see how this tool can make calculating your estimated mortgage payment easier.

WHAT’S A MORTGAGE CALCULATOR?

A mortgage or home loan calculator is a digital tool that estimates your yearly payment and the terms of your mortgage. These free tools offer substantiated loan recommendations that may include effects like:

- Yearly mortgage payments, including a breakdown of the interest, property duty, homeowner’s insurance, private mortgage insurance (PMI), and homeowner’s association (HOA) fees,

- Length of a mortgage

- Adjustable and Fixed interest rate

- Interest rate and periodic chance rate (APR)

- Closing costs, which may include attorney or lender fees, title insurance, and other charges

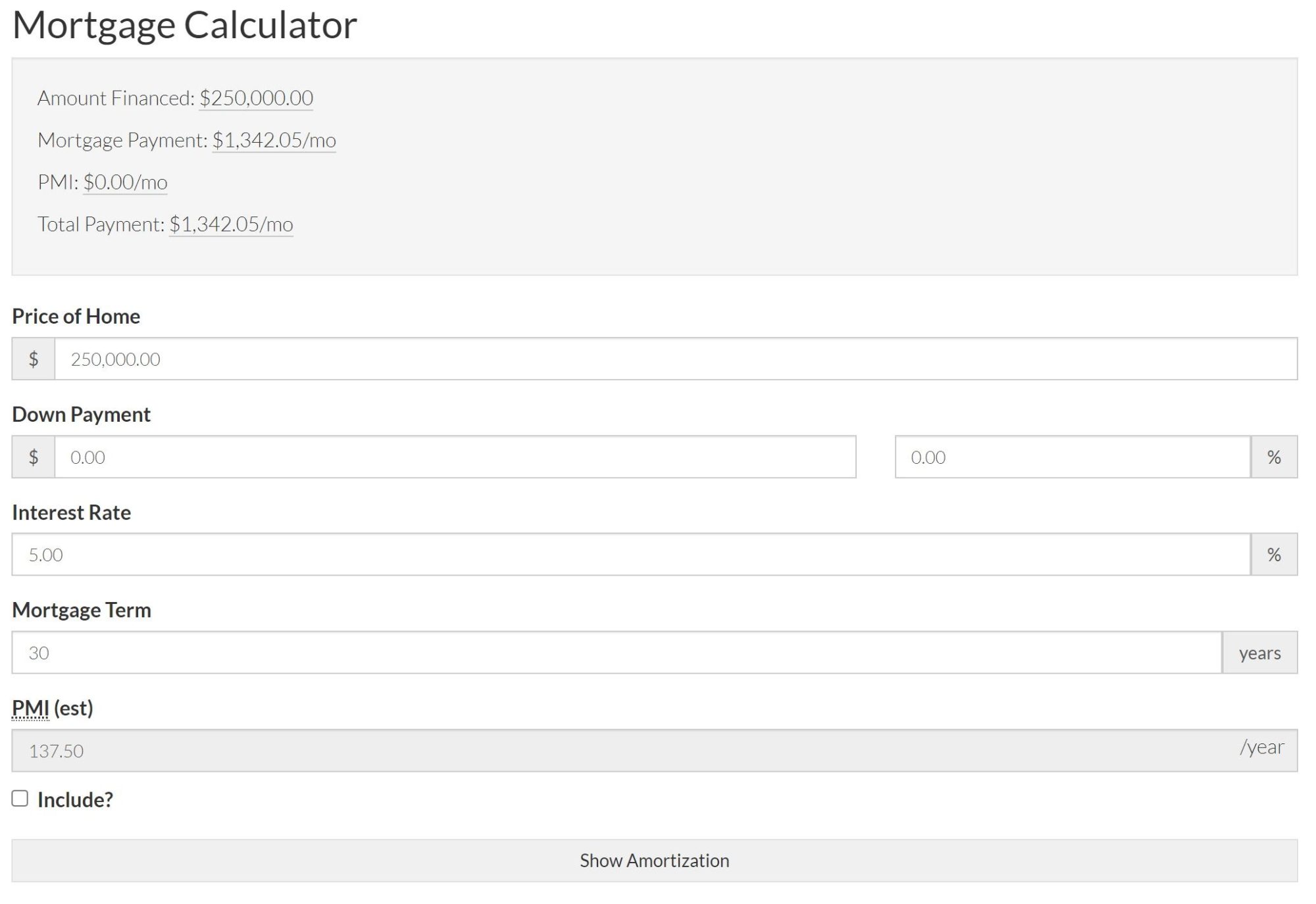

To estimate your yearly mortgage payment, mortgage calculators bear user input. For example, you might need to give

- Price of the home you plan to buy

- Down payment amount

- Property position and type

- Yearly interest, insurance, and HOA fees

- Your credit score and other particular information

These calculators are helpful when you want to see estimates for different types of mortgages you might qualify for or if you want to see how different loan terms would affect your yearly payments.

HOW TO USE A MORTGAGE CALCULATOR

To use a mortgage calculator, collect the information listed over. Also, follow the ways below to estimate your yearly mortgage payment and review home loan options.

LOAN TYPE

First, choose the type of home loan you want, so the calculator displays the right fields. Options include

- Home purchase: Choose this option if you are copping a house, hutch, or condo.

- Refinance: If you want to replace your current mortgage with a new home loan, choose this option.

- Cash-out refinances: Pick this option when you want to pierce the equity in your home.

Interest rates and mortgage terms tend to be analogous for home purchases, mortgage refinances, and cash-out refinances. Still, most lenders offer the best interest rates only if your loan-to-value rate (LTV) is 80 or lower.

HOME PRICE OR CURRENT PROPERTY VALUE

Next, enter the price of the home, which you can get from the property listing or the most recent appraisal. You can also use a home value estimator if you want to calculate the market value of any home you’d like to buy or refinance.

DOWN PAYMENT OR MORTGAGE BALANCE

Enter the down payment you plan to make if you are buying a home. You can either enter the bone amount of the home price. However, the chance automatically calculates, and vice versa, If you enter the amount. Advanced down payment may qualify you for a lower interest rate. However, you may have to pay private mortgage insurance (PMI), If your down payment equals lower than 20 of the home price. In most cases, PMI equals 1 of your mortgage balances.

CREDIT SCORE

Still, get a copy of your credit report if you do not know your current credit score. Also, choose the dropdown menu and choose the range that includes your credit score.

Your credit score is one factor used to determine which loan products you might qualify for. Utmost lenders offer you options grounded on your credit score and other factors like your yearly income and your debts. However, you may qualify for a lower interest rate, If you have a credit score of 740 or over.

PROPERTY TYPE

To get further fine-tuned mortgage options, choose the «Advanced» link to answer as many fresh questions as possible. Also, choose the type of property you plan to finance. Choices include:

- Single-family home

- Condominium

- Hutch

- Two-family home

- Three-family home

- Four-family home

Mortgages for certain property types generally have different interest rate ranges. For example, single-family homes frequently have lower interest rates than condos. Not all lenders offer mortgages for condominiums, so there’s lower competition, and mortgages for condominiums are kindly unsafe than for single-family homes.

HOW DO YOU PLAN TO USE THE PROPERTY?

Next, choose whether you plan to use the home as your primary hearthstone, an alternate or holiday home, or investment or rental property. Lenders may offer different interest rates grounded on your intended use. For example, interest rates for investment property and holiday homes are frequently advanced than those for primary places.

PARTICULAR INFORMATION

Choose the circles to indicate whether you are a United States citizen or a first-time homebuyer. However, you could qualify for certain home loan products, If both. For example, you might be eligible for a loan from the Federal Housing Administration (FHA). Since they generally offer low down payment options and low ending costs, FHA loans (Opens Overlay) are frequently more affordable.

HOMEOWNERS INSURANCE

Next, enter the homeowner’s insurance you will need to pay each month. To get this number, you can call your insurance company. Your insurance provider may also offer a calculator on their website.

Like property duty, homeowner’s insurance does not affect your loan amount. Still, most lenders include it in your mortgage payment also pay for you.

HOA FEES

Finally, enter the yearly HOA fees. You can find this information on the property table, which should indicate if the house belongs to an HOA and any applicable fees. However, leave this section blank, If the house does not have an HOA.

HOA fees aren’t included in your mortgage payment, but they affect your overall yearly casing cost.

CALCULATE YOUR MORTGAGE PAYMENTS

Once you’ve entered all the information in the mortgage calculator, choose the “Show Amortization” button to see your options. You can review the top recommendation and choose the other suggestions to see how your yearly payment would change with a different loan term or interest rate. To move forward with applying for one of these loan options, choose the “Launch online” button to get prequalified for a mortgage.

When you are getting ready to buy or refinance a home, it’s important to make a smart move. With our mortgage calculator at your fingertips, you can quickly assess your loan options and your yearly costs so you can make an informed decision. Contact me for more information, or you can find me on the Compass as well.