WHAT CREDIT SCORE DO YOU NEED FOR A MORTGAGE?

There is some misconception that you need a minimum credit score to get a mortgage. However, each lender will view your credit history differently, counting on factors like your age, income, and therefore the reference agencies they use, which all have slightly different scoring systems. Here is everything you need to understand about your credit score and mortgages.

WHAT IS A CREDIT SCORE?

Your credit score or rating is an image of how reliable you’re at borrowing money, in the eyes of a specific agency or lender. Your score is improved by positive actions, like regularly paying off loans on time or using a Credit card sensibly. Meanwhile, it is strongly affected by negative actions like missing payments and going over your agreed credit limit. So far, so obvious. However, none of us has a ‘universal credit score’, as each lender interprets our history slightly differently. Most use similar criteria to assess how good your credit history is, but some consider might not be treated so harshly by others (and vice versa).

WHAT IS THE SMALLEST CREDIT SCORE YOU NEED TO GET A MORTGAGE?

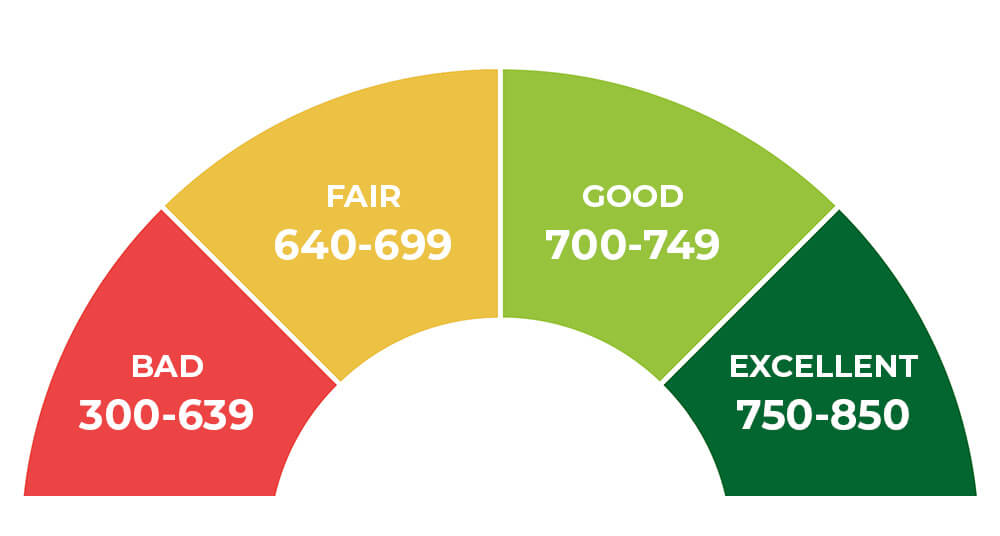

There is not a group of numbers that will automatically make you eligible for a mortgage. This is partly because getting a mortgage depends on your credit score, and partly because agencies and lenders may use wildly different scoring systems, therefore the numbers are not comparable.

It is always the case that the higher your credit score, the higher your chance of securing a mortgage offer and getting access to attractive interest rates. However, if your credit score isn’t considered a minimum of decent, you’ll likely struggle to get a mortgage.

Currently, there are three major credit reference agencies (CRAs): Experian, Equifax, and TransUnion. Each of those uses its unique credit rating system. Experian’s system ranges from 0-999, and anything below 721 is measured poor. TransUnion scores borrowers from 0-710 and also has five ‘rating’ bands (with five being the best and one the worst), and any score below 566 (which is that the bottom of band 3) is considered poor. Equifax features a scale that runs from 0- 700 and anything below 380 is poor. So, you can see how different the scales are.

WHAT IS A GOOD CREDIT SCORE

Each CRA assesses your credit history a bit differently and uses a singular rating system. Here’s a rough guide to what the three biggest consider an honest credit score:

THE IMPACT OF COVID-19

With historic low interest rates as a result of the COVID-19 pandemic, credit scores may have less of an impression on your loan rates than they would in a typical economy. Consider the same setup from above in the current climate of 2021

Effect of Credit Score on Loan Rates (2021)

Credit Score Range Interest Rate

620 to 639 2.250% to 3.875%

640 to 659 2.250% to 3.875%

660 to 679 2.250% to 3.875%

680 to 699 2.250% to 3.875%

700 to 719 2.250% to 3.875%

720 to 739 2.250% to 3.875%

740 to 850 2.250% to 3.875%

While the pandemic has had an outsized impact on interest rates, it isn’t something you can calculate year after year.

BOOSTING YOUR CREDIT SCORE

If you have bad credit but are a first-time buyer, start maximizing your score before you start house hunting. Check your credit score so you recognize where you stand, review your credit history to make sure it’s accurate, and remember to consistently pay your bills on time.

When lenders see multiple applications for credit reported during a short period of your time, it can discourage them from supplying you with a loan. So, here’s a brief list of things to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards

- Avoid closing credit cards

- Avoid applying for new loans

- Avoid co-signing on any new loans

WHAT IS A GOOD CREDIT SCORE FOR PURCHASING A MORTGAGE?

We’ve only discussed the lowest credit score that a mortgage lender will consider. But what kind of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

FICO Credit Score Ranges

Below 580 Very Poor

580 to 669 Fair

670 to 739 Good

740 to 799 Very Good

800 and above Exceptional

- Pointing to get your credit score in the «Good» range (670 to 739) would be an excellent start to qualifying for a mortgage. But if you’re wanting to qualify for rock bottom rates, try to get your score in the «Very Good» range (740 to 799).

- It’s important to point out your credit score is not the only factor that lenders consider during the underwriting process. Even with a robust score, a scarcity of income or employment history or a high debt-to-income ratio could cause the loan to fall.

HOW CREDIT SCORES AFFECT MORTGAGE INTEREST RATES?

Your credit score has a serious impact on the general cost of your loan. Each day, FICO publishes data that shows how your credit score could affect your rate of interest and payment. Below is a chart of the monthly cost of a $200,000, 30-year fixed-rate mortgage in May 2021:

Credit score APR Monthly payment

760-850 2.617% $802

700-759 2.839% $826

680-699 3.016% $845

660-679 3.230% $868

640-659 3.660% $916

620-639 4.206% $979

- That’s an interest variance of over 1.5% and a $177 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

- Those differences can add up over time. Consistent with the buyer Financial Protection Bureau (CFPB), a $200,000 home with a 4.00% rate of interest costs $61,670 more overall over 30 years than a mortgage with a 2.25% rate of interest.

HOW TO IMPROVE YOUR CREDIT SCORE BEFORE YOU PURCHASE A MORTGAGE?

The first step to enlightening your score is to find out where you stand. During the coronavirus pandemic, you’ll check your credit report for free of charge weekly with all three major credit bureaus (TransUnion, Equifax, and Experian) at AnnualCreditReport.com.

If you discover errors on any of your reports, you’ll dispute them with the agency also like the lender or Credit card company. When it involves your credit score, your bank or Credit card issuer may provide your score free of charge.

What are you able to do if you find that your score needs improvement? One idea would be to pay down your Credit card balances to scale back your credit utilization rate. Also, avoid applying for any new kind of credit during the months leading up to a loan application.

And, most significantly, pay your bills on time each and each month. Your payment history is that the factor that has the most important influence on your credit score. Building a uniform history of on-time payments will always be a surefire way to improving your score.

FINAL THOUGHTS

Buying a house is stressful, but you will take a lot of stress out of the equation if you enter it with good credit. It requires patience, self-discipline, and sacrifice, but it will all be worthwhile when you are sitting in your cozy new home as a primary-time homebuyer.

Izabella Lipetski the top real estate agent in East Bay California is just a click away! You can be on the right track to a far better credit score for a mortgage, and lower interest rates are going to be achievable!